salt tax cap news

2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap. Your Family Can Live With a 30000 SALT Deduction Cap.

Salt Tax Repealed By House Democrats The Washington Post

Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US.

. Democrats from high-tax states such as New York and New Jersey want the spending package to undo the 10000 cap on the state and local tax SALT deduction. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. New York led a group including.

The United States Supreme Court rejected New Jersey and other states requests to restore the full income tax deduction for. For example policymakers have proposed doubling the cap for married couples or making it more generous. SALT Tax-Cap Challenge by New York and New Jersey Is Tossed.

News News Based on facts. Capitol on April 15 2021. Dave Goldiner New York Daily News 1152021.

Include a repeal of the federal cap on deductions for state and local taxes or SALT. Paul Oetken threw out a lawsuit saying the federal government has the exhaustive power to impose and collect income taxes and that the states can enact their own tax policies as they wish. Americans who rely on the state and local tax SALT deduction at.

Organizing an LLC for your business can convert non-deductible SALT into a business expense. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000. Both Gottheimer and Suozzi have been some of the most vocal advocates for SALT playing a pivotal role in getting the language to increase the cap from 10000 to 80000 into the House-passed.

March 1 2022 600 AM 5 min read. 12There has been a lot of discussion amongst government leaders about the cap on state and local tax SALT deductions. Under current law the 10000 cap would expire in 2025 along with most other individual income tax provisions for the 2017 Tax Cuts and Jobs Act TCJA.

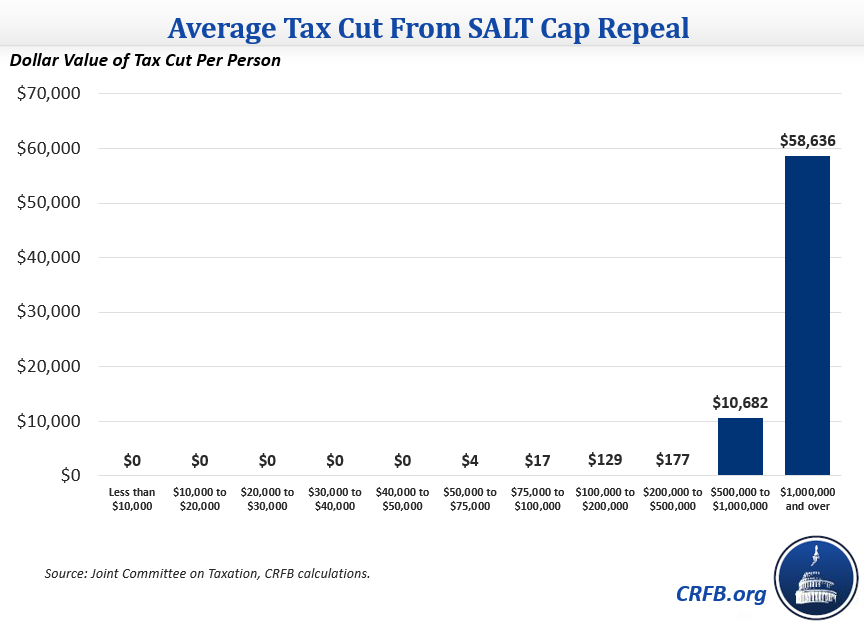

December 12 2021 930 AM 4 min read. Seventeen states have enacted SALT cap workaround laws and several others are working towards. Repealing the cap on SALT tax deductions would disproportionately benefit wealthy Americans.

House Speaker Nancy Pelosi signaled support this week for including a repeal of the 10000 cap on. Capitol on April 15 2021. Laws in 27 states let owners circumvent the 10000 annual limit on state and local tax deductions in their federal tax filings with savings likely totaling at least 10 billion.

The state and local tax deduction cap commonly known as SALT was enacted as part of President Donald Trumps 2017 tax reforms. A new bill seeks to repeal the 10000 cap on state and local tax deductions. Seven statesCalifornia New York Texas New Jersey Maryland Illinois and Floridaclaimed more than half of the value of all SALT deductions nationwide in 2018.

She oversaw tax coverage for Bloomberg News. Bill Pascrell D-NJ speaks at a news conference announcing the State and Local Taxes SALT Caucus outside the US. This was true prior to the SALT deduction cap and remained the case in 2018.

This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. The Biden Administrations Build Back Better Act proposes raising the cap currently set at 10 000 to 80 000. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

The Supreme Court Monday rejected an appeal from several states challenging Congresss cap on state and local taxes that can be deducted from federal taxable income. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. Said at a news conference on.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. The SALT deduction tends to benefit states with many higher-earners and higher state taxes. Taxpayers can deduct up to 10000 of the state and local.

The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions. At least hes trying. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

The higher cap would remain in effect. But what is the SALT cap. As alternatives to a full repeal of the cap lawmakers and experts have proposed a number of changes to the SALT deduction.

And while its presently due to sunset in 2025 Suozzi should. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. Not in these quarters.

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

How To Deduct State And Local Taxes Above Salt Cap

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

U S Rep Brad Schneider Named To Ways Means Vows Salt Deduction Battle Deduction Battle Vows

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

House Raises Salt Tax Deduction Cap From 10k To 80k In Build Back Better Senate Plans Changes So Millionaires Won T Get Tax Cut Yonkers Times

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Most New York Times Matt Dorfman Design Illustration Illustration Design Newspaper Design Health Magazine Layout

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version